We’re collaborating with MyPath, a national nonprofit based in San Francisco, CA, to continue delivering financial products for low-income individuals. Backed by a sponsorship from JPMorgan Chase, we’ve joined forces to uncover the next iteration of MyPath Money, both on the Savings and Credit programs.

Since our partnership began in 2015, MyPath’s youth financial capability model has grown from two cities to twelve cities nationwide. In 2018, our aim is to increase programming in San Antonio, Los Angeles, Newark, New York, San Francisco and Seattle in order to give to up to 6,000 young people the opportunity to achieve financial health.

MyPath is an ideal partner.

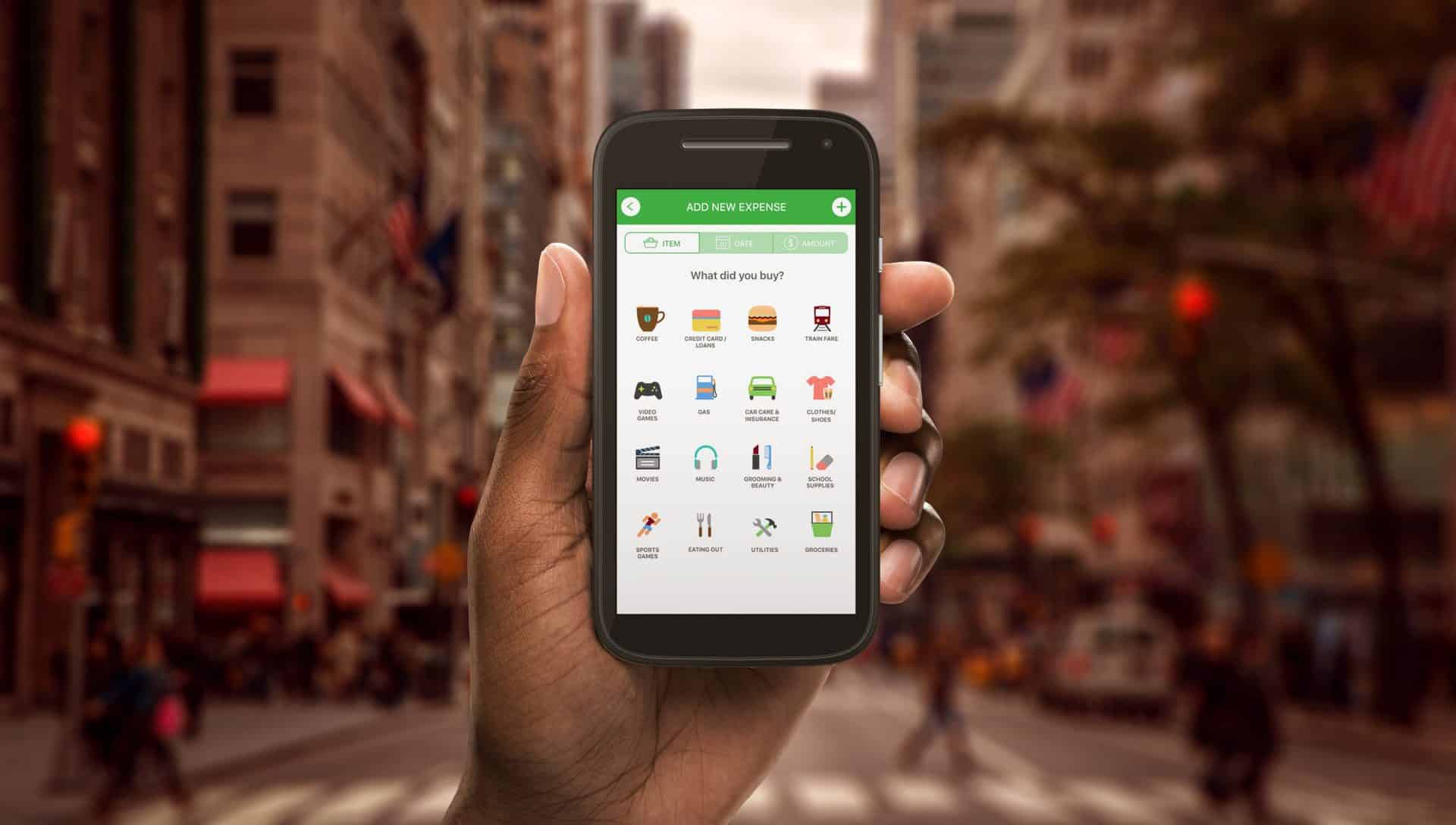

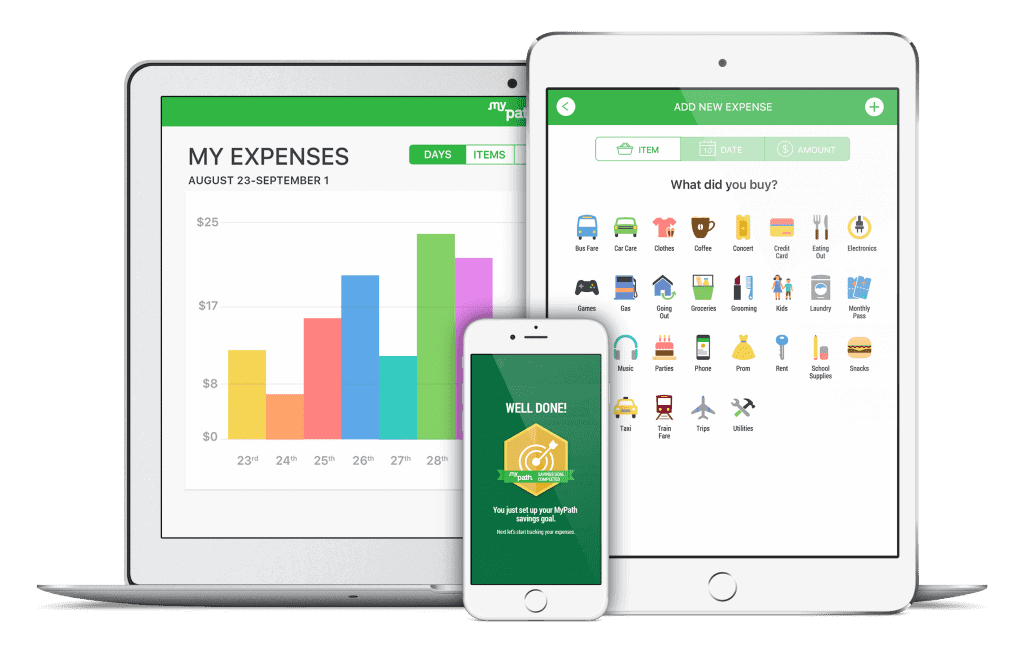

Their social mission is one that meets people where they are, helps educate them about financial health, and empowers them to change their story to one of financial opportunity. The MyPath Savings program was already a great success; the number of participants meeting their savings goals and completing the program pointed to something worth scaling to other cities. Technology opened doors for their small team to both reach beyond their office and nearby cities and see success across the nation and grow their team. The first version of MyPath Savings is now in twelve cities helping students find financial confidence.

A few months ago, we were at a workshop in San Francisco exploring how technology could help scale the MyPath Credit programs as it had for MyPath Savings. Lauren Larin, former managing director of programs, and Carlo Solis, senior program manager shared with me an eye opening concept that I later relayed back to my team as we uncovered this mission and importance of the work ahead:

“Some of the young adults who need this program have bad credit not because of their own choices, but because of identity theft and a choices of those around them.”

I can’t imagine starting my adult life in this way, but I know that it happens. It’s worse that having no credit at all. They’re unable to start their lives with a clean slate. They start their adult life by digging themselves out of a hole they quite possibly didn’t create. They can’t rent an apartment or buy a car. Their trustworthiness is based on a number that is not truly one they should own. It’s an instance where the systems and technology that were created to protect us, have failed us.

So what can we do to remedy the situation?

People are not born into the environment of their choosing. As a company who strives to bring equality, opportunity, and voice to those less fortunate, this is a problem worth solving. We may not be able to tackle the entire system that placed these young adults in the position they are in, but we can help them in other ways and we believe that MyPath’s Savings and Credit programs will provide that bridge to financial success.

Looking Ahead

Over the next few months our focus will be on enhancing the user experience for the Savings Program, giving program managers more tools to assist more young people. Alongside this work, more research is being done to scale the credit programs. Partnerships with credit unions, loan programs for lower-income individuals and other social enterprises working in financial literacy and empowerment are being explored for potential collaboration and implementation. We’re excited about all that 2018 holds for our partnership and the good that will come out of this for years to come.